What mistakes to avoid while filing for a tax return?

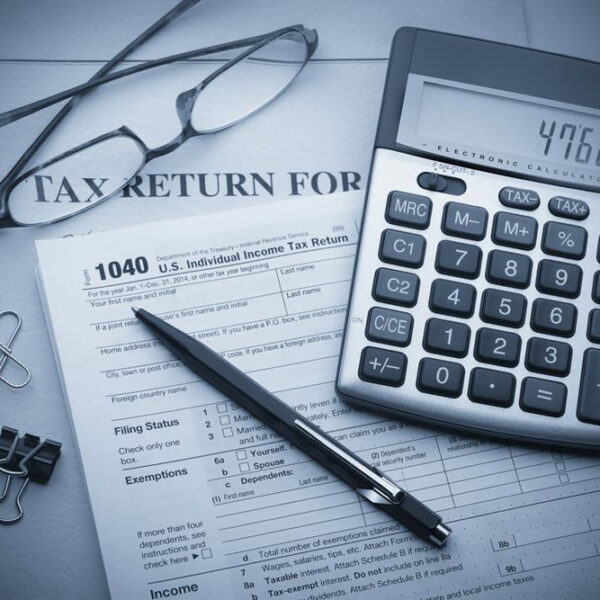

Tax is a part of money contributed to the state revenue, levied by the government on an employee’s/citizen’s income or imposed on the purchase of goods. Tax returns are the reports used to calculate the income tax or other taxes. They are usually filed with the IRS or state or local tax collection agency. The IRS or other taxing authority has a standard form prescribed for all the tax payers to fill in. At times you are prone to make mistakes while filling out your tax returns but this can cause major financial losses as well as excessive paperwork. Therefore, it is of utmost significance that you meticulously deal with the tax returns. These are the 4 things that you should know about tax return, that can help you avoid major mistakes. Fill in the right status of your situation If you are the sole breadwinner of a household, a widower with a dependent child, or a senior, then it can considerably help you get some tax incentives. So, always make sure that you are aware about the exemptions provided to people belong to specific categories, and get the details right. Married couples may pay less tax if they submit separate tax forms rather than jointly.